l10n_se_chemical_tax

by Vertel AB

14.0

| Category |

Customer Relationship Management

|

| Technical Name |

|

| License |

LGPL-3

|

| Website | https://vertel.se/apps/odoo-l10n_se/l10n_se_chemical_tax |

Get a chemical tax report in Sales report view.

Depends on modules sale, product, stock and l10n_se

Add fields for chemical tax and max tax in product category.

Depends on modules sale, product, stock and l10n_se

Add fields for chemical tax and max tax in product category.

Chemical tax

Chemical tax For companies that must report chemical tax to the Swedish Tax Agency.

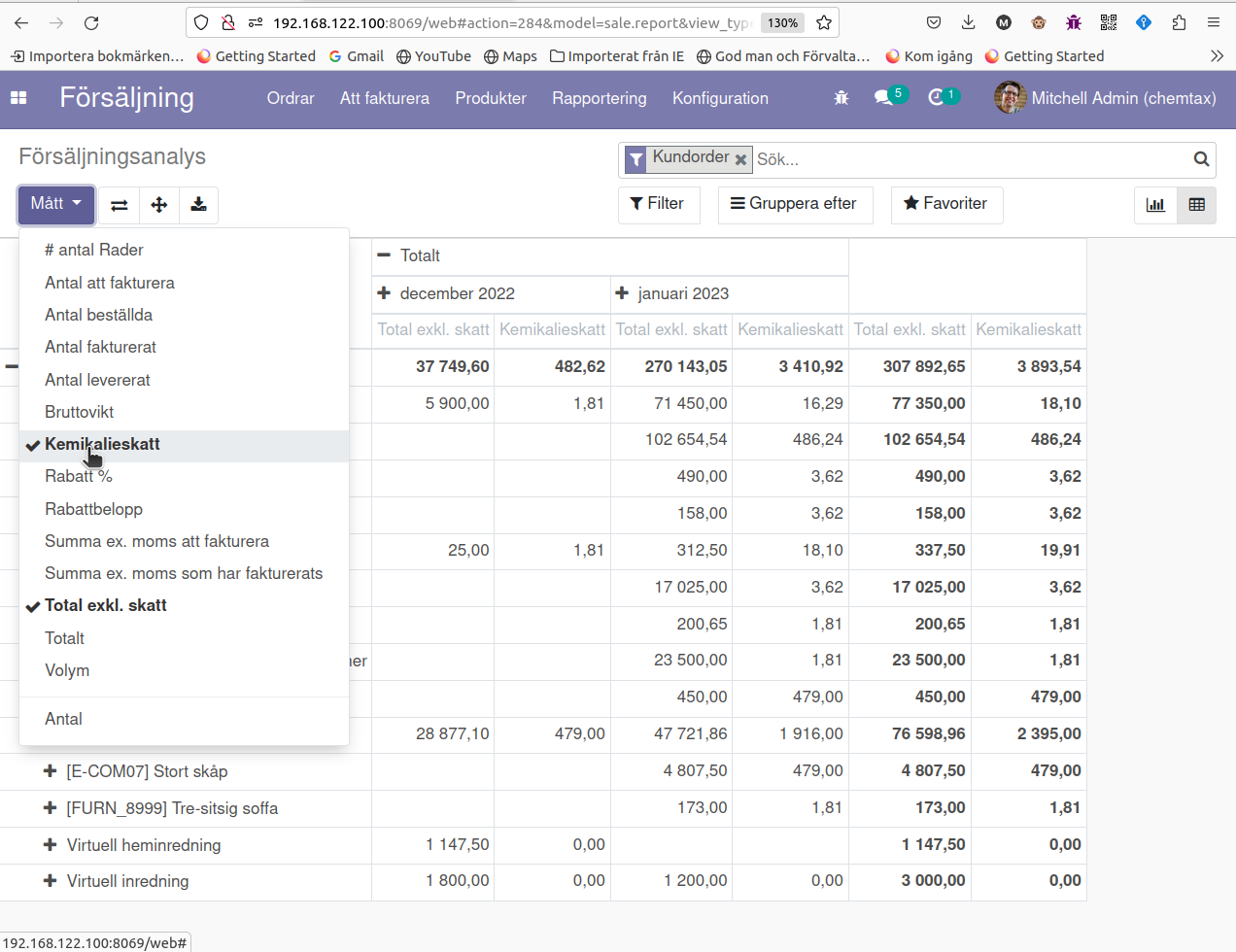

Get a chemical tax report in Sales report view.

Depends on modules sale, product, stock and l10n_seAdd fields for chemical tax and max tax in product category.

Installation

This module needs these modules to work:l10n_se: Sweden - Accounting (l10n_se)

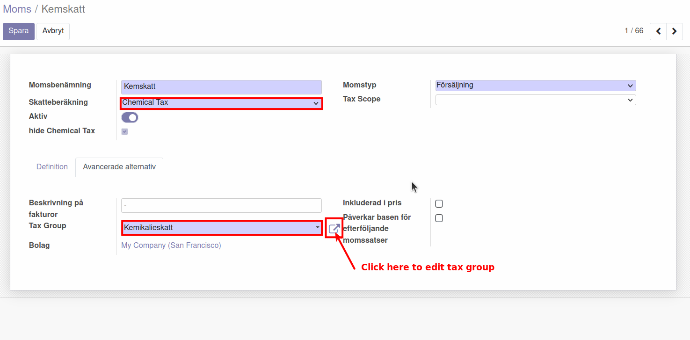

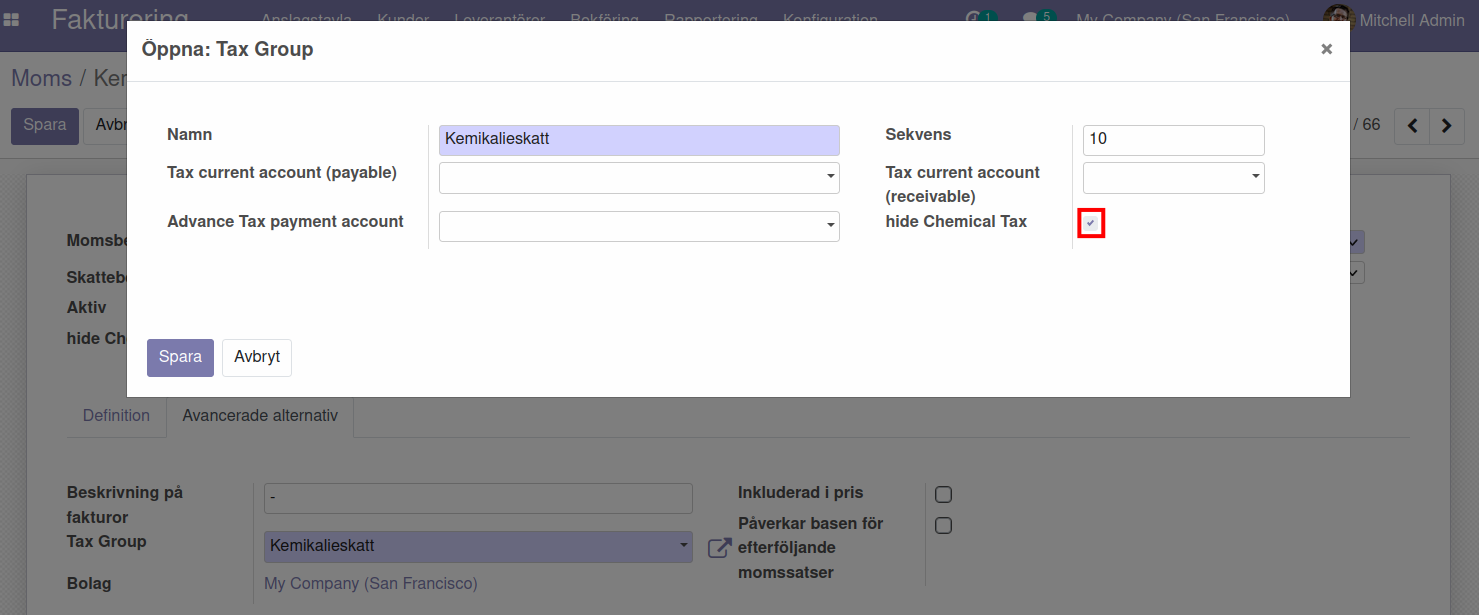

Go to Invoicing: Configuration/Taxes and add a tax. Enter a name then choose Chemical Tax for Tax Computation. Choose Kemikalieskatt as Tax Group and the click the external link. Make sure that Hide Chemical Tax is checked.

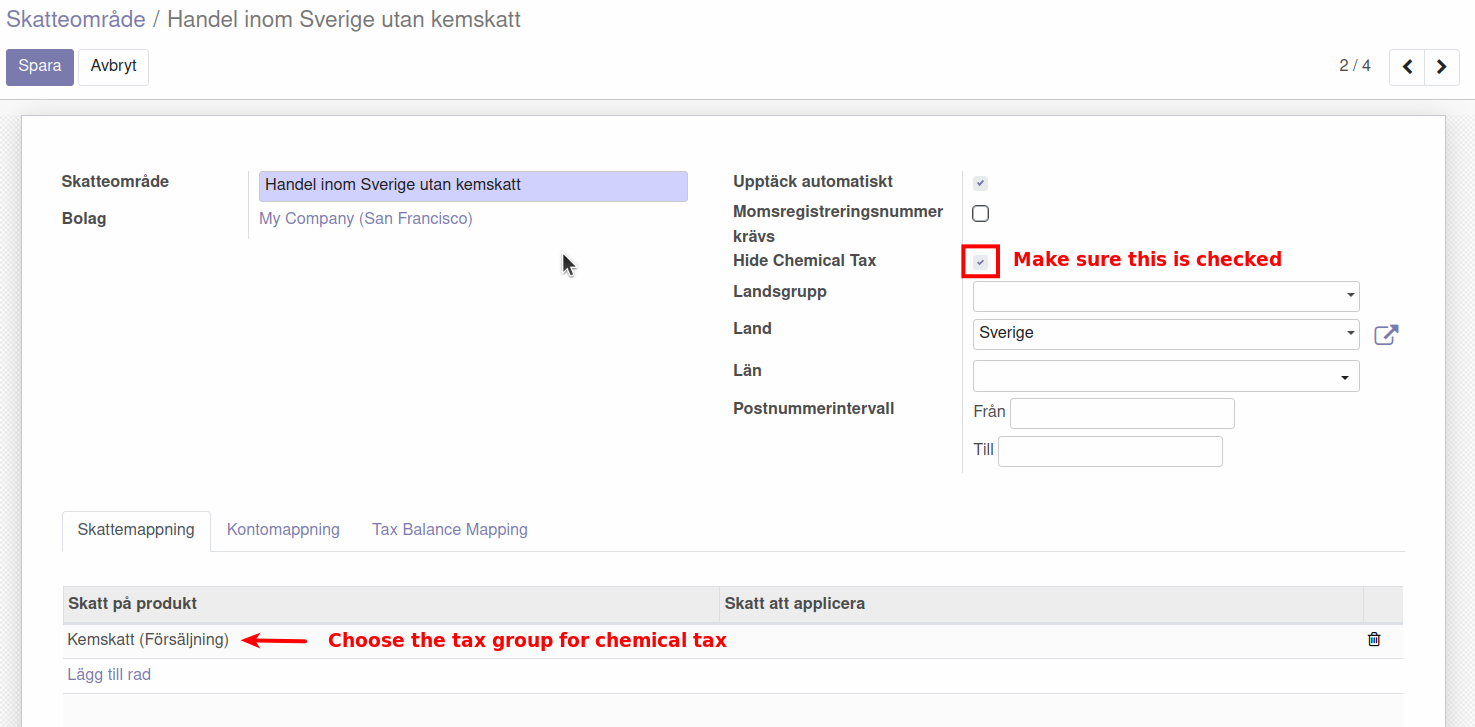

Go to Invoicing: Configuration/Fiscal Positions and create an new. Add the tax group we created previously. Make sure Hide Chemical Tax is checked

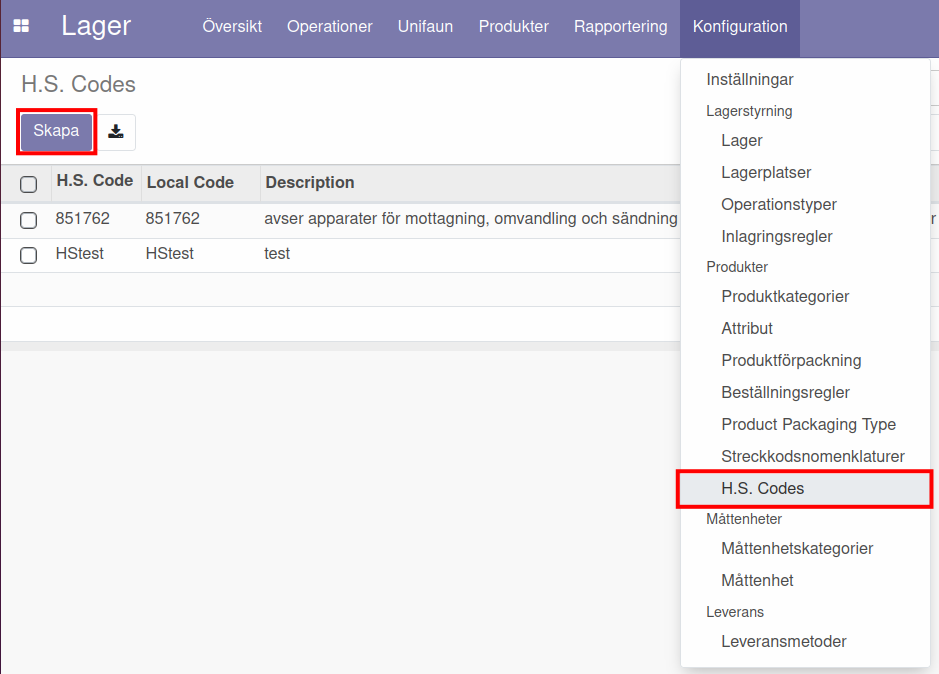

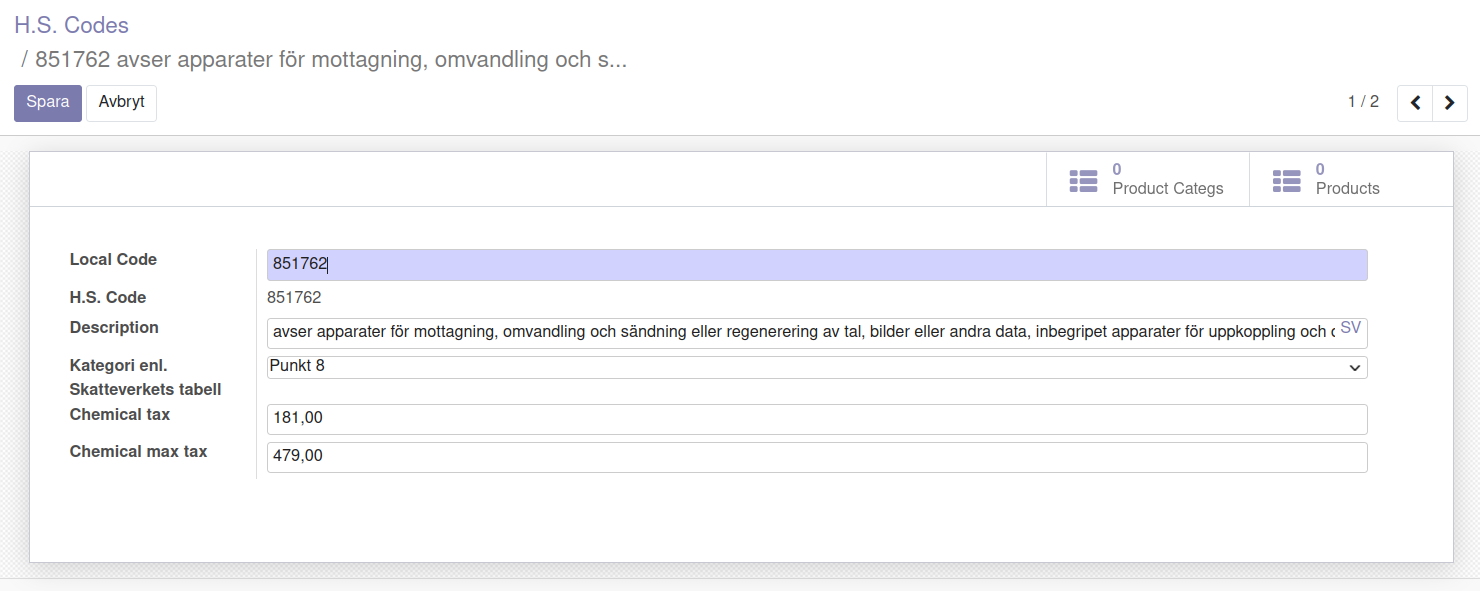

Go to Inventory: Configuration/H.S. Codes and create the code you need. Fill in the current tax rates from the Swedish Tax Agency.

By configurating the customer we can choose whether the tax will be calculated or not. Edit the customer and under the tab Sales & Purchase you can choose Fiscal Position.

Usage

The report can be viewed in the pivot view for Sales -> Sales analysis.Select Chemical Tax as Measure